Page 196 - DSD ANNUAL REPORT 2022-2

P. 196

PART E: FINANCIAL INFORMATION

Notes of the Annual Financial Statements for the year ended 31 March 2022

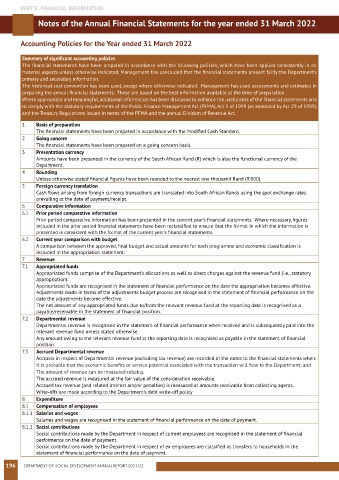

Accounting Policies for the Year ended 31 March 2022

Summary of significant accounting policies

The financial statements have been prepared in accordance with the following policies, which have been applied consistently in all

material aspects unless otherwise indicated. Management has concluded that the financial statements present fairly the Department’s

primary and secondary information.

The historical cost convention has been used, except where otherwise indicated. Management has used assessments and estimates in

preparing the annual financial statements. These are based on the best information available at the time of preparation.

Where appropriate and meaningful, additional information has been disclosed to enhance the usefulness of the financial statements and

to comply with the statutory requirements of the Public Finance Management Act (PFMA), Act 1 of 1999 (as amended by Act 29 of 1999),

and the Treasury Regulations issued in terms of the PFMA and the annual Division of Revenue Act.

1 Basis of preparation

The financial statements have been prepared in accordance with the Modified Cash Standard.

2 Going concern

The financial statements have been prepared on a going concern basis.

3 Presentation currency

Amounts have been presented in the currency of the South African Rand (R) which is also the functional currency of the

Department.

4 Rounding

Unless otherwise stated financial figures have been rounded to the nearest one thousand Rand (R’000).

5 Foreign currency translation

Cash flows arising from foreign currency transactions are translated into South African Rands using the spot exchange rates

prevailing at the date of payment/receipt.

6 Comparative information

6.1 Prior period comparative information

Prior period comparative information has been presented in the current year’s financial statements. Where necessary, figures

included in the prior period financial statements have been reclassified to ensure that the format in which the information is

presented is consistent with the format of the current year’s financial statements.

6.2 Current year comparison with budget

A comparison between the approved, final budget and actual amounts for each programme and economic classification is

included in the appropriation statement.

7 Revenue

7.1 Appropriated funds

Appropriated funds comprise of the Department’s allocations as well as direct charges against the revenue fund (i.e., statutory

appropriation).

Appropriated funds are recognised in the statement of financial performance on the date the appropriation becomes effective.

Adjustments made in terms of the adjustments budget process are recognised in the statement of financial performance on the

date the adjustments become effective.

The net amount of any appropriated funds due to/from the relevant revenue fund at the reporting date is recognised as a

payable/receivable in the statement of financial position.

7.2 Departmental revenue

Departmental revenue is recognised in the statement of financial performance when received and is subsequently paid into the

relevant revenue fund unless stated otherwise.

Any amount owing to the relevant revenue fund at the reporting date is recognised as payable in the statement of financial

position.

7.3 Accrued Departmental revenue

Accruals in respect of Departmental revenue (excluding tax revenue) are recorded in the notes to the financial statements when:

It is probable that the economic benefits or service potential associated with the transaction will flow to the Department; and

The amount of revenue can be measured reliably.

The accrued revenue is measured at the fair value of the consideration receivable.

Accrued tax revenue (and related interest and/or penalties) is measured at amounts receivable from collecting agents.

Write-offs are made according to the Department’s debt write-off policy

8 Expenditure

8.1 Compensation of employees

8.1.1 Salaries and wages

Salaries and wages are recognised in the statement of financial performance on the date of payment.

8.1.2 Social contributions

Social contributions made by the Department in respect of current employees are recognised in the statement of financial

performance on the date of payment.

Social contributions made by the Department in respect of ex-employees are classified as transfers to households in the

statement of financial performance on the date of payment.

196 DEPARTMENT OF SOCIAL DEVELOPMENT ANNUAL REPORT 2021/22