Page 197 - DSD ANNUAL REPORT 2022-2

P. 197

PART E: FINANCIAL INFORMATION

Notes of the Annual Financial Statements for the year ended 31 March 2022

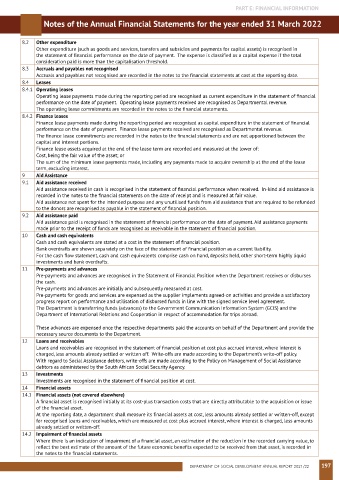

8.2 Other expenditure

Other expenditure (such as goods and services, transfers and subsidies and payments for capital assets) is recognised in

the statement of financial performance on the date of payment. The expense is classified as a capital expense if the total

consideration paid is more than the capitalisation threshold.

8.3 Accruals and payables not recognised

Accruals and payables not recognised are recorded in the notes to the financial statements at cost at the reporting date.

8.4 Leases

8.4.1 Operating leases

Operating lease payments made during the reporting period are recognised as current expenditure in the statement of financial

performance on the date of payment. Operating lease payments received are recognised as Departmental revenue.

The operating lease commitments are recorded in the notes to the financial statements.

8.4.2 Finance leases

Finance lease payments made during the reporting period are recognised as capital expenditure in the statement of financial

performance on the date of payment. Finance lease payments received are recognised as Departmental revenue.

The finance lease commitments are recorded in the notes to the financial statements and are not apportioned between the

capital and interest portions.

Finance lease assets acquired at the end of the lease term are recorded and measured at the lower of:

Cost, being the fair value of the asset; or

The sum of the minimum lease payments made, including any payments made to acquire ownership at the end of the lease

term, excluding interest.

9 Aid Assistance

9.1 Aid assistance received

Aid assistance received in cash is recognised in the statement of financial performance when received. In-kind aid assistance is

recorded in the notes to the financial statements on the date of receipt and is measured at fair value.

Aid assistance not spent for the intended purpose and any unutilised funds from aid assistance that are required to be refunded

to the donors are recognised as payable in the statement of financial position.

9.2 Aid assistance paid

Aid assistance paid is recognised in the statement of financial performance on the date of payment. Aid assistance payments

made prior to the receipt of funds are recognised as receivable in the statement of financial position.

10 Cash and cash equivalents

Cash and cash equivalents are stated at a cost in the statement of financial position.

Bank overdrafts are shown separately on the face of the statement of financial position as a current liability.

For the cash flow statement, cash and cash equivalents comprise cash on hand, deposits held, other short-term highly liquid

investments and bank overdrafts.

11 Pre-payments and advances

Pre-payments and advances are recognised in the Statement of Financial Position when the Department receives or disburses

the cash.

Pre-payments and advances are initially and subsequently measured at cost.

Pre-payments for goods and services are expensed as the supplier implements agreed-on activities and provide a satisfactory

progress report on performance and utilisation of disbursed funds in line with the signed service level agreement.

The Department is transferring funds (advances) to the Government Communication Information System (GCIS) and the

Department of International Relations and Cooperation in respect of accommodation for trips abroad.

These advances are expensed once the respective departments paid the accounts on behalf of the Department and provide the

necessary source documents to the Department.

12 Loans and receivables

Loans and receivables are recognised in the statement of financial position at cost plus accrued interest, where interest is

charged, less amounts already settled or written off. Write-offs are made according to the Department’s write-off policy.

With regard to Social Assistance debtors, write-offs are made according to the Policy on Management of Social Assistance

debtors as administered by the South African Social Security Agency.

13 Investments

Investments are recognised in the statement of financial position at cost.

14 Financial assets

14.1 Financial assets (not covered elsewhere)

A financial asset is recognised initially at its cost-plus transaction costs that are directly attributable to the acquisition or issue

of the financial asset.

At the reporting date, a department shall measure its financial assets at cost, less amounts already settled or written-off, except

for recognised loans and receivables, which are measured at cost plus accrued interest, where interest is charged, less amounts

already settled or written-off.

14.2 Impairment of financial assets

Where there is an indication of impairment of a financial asset, an estimation of the reduction in the recorded carrying value, to

reflect the best estimate of the amount of the future economic benefits expected to be received from that asset, is recorded in

the notes to the financial statements.

DEPARTMENT OF SOCIAL DEVELOPMENT ANNUAL REPORT 2021/22 197