Page 198 - DSD ANNUAL REPORT 2022-2

P. 198

PART E: FINANCIAL INFORMATION

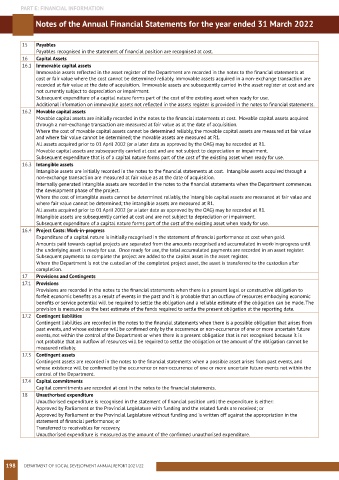

Notes of the Annual Financial Statements for the year ended 31 March 2022

15 Payables

Payables recognised in the statement of financial position are recognised at cost.

16 Capital Assets

16.1 Immovable capital assets

Immovable assets reflected in the asset register of the Department are recorded in the notes to the financial statements at

cost or fair value where the cost cannot be determined reliably. Immovable assets acquired in a non-exchange transaction are

recorded at fair value at the date of acquisition. Immovable assets are subsequently carried in the asset register at cost and are

not currently subject to depreciation or impairment.

Subsequent expenditure of a capital nature forms part of the cost of the existing asset when ready for use.

Additional information on immovable assets not reflected in the assets register is provided in the notes to financial statements.

16.2 Movable capital assets

Movable capital assets are initially recorded in the notes to the financial statements at cost. Movable capital assets acquired

through a non-exchange transaction are measured at fair value as at the date of acquisition.

Where the cost of movable capital assets cannot be determined reliably, the movable capital assets are measured at fair value

and where fair value cannot be determined; the movable assets are measured at R1.

All assets acquired prior to 01 April 2002 (or a later date as approved by the OAG) may be recorded at R1.

Movable capital assets are subsequently carried at cost and are not subject to depreciation or impairment.

Subsequent expenditure that is of a capital nature forms part of the cost of the existing asset when ready for use.

16.3 Intangible assets

Intangible assets are initially recorded in the notes to the financial statements at cost. Intangible assets acquired through a

non-exchange transaction are measured at fair value as at the date of acquisition.

Internally generated intangible assets are recorded in the notes to the financial statements when the Department commences

the development phase of the project.

Where the cost of intangible assets cannot be determined reliably, the intangible capital assets are measured at fair value and

where fair value cannot be determined; the intangible assets are measured at R1.

All assets acquired prior to 01 April 2002 (or a later date as approved by the OAG) may be recorded at R1.

Intangible assets are subsequently carried at cost and are not subject to depreciation or impairment.

Subsequent expenditure of a capital nature forms part of the cost of the existing asset when ready for use.

16.4 Project Costs: Work-in-progress

Expenditure of a capital nature is initially recognised in the statement of financial performance at cost when paid.

Amounts paid towards capital projects are separated from the amounts recognised and accumulated in work-in-progress until

the underlying asset is ready for use. Once ready for use, the total accumulated payments are recorded in an asset register.

Subsequent payments to complete the project are added to the capital asset in the asset register.

Where the Department is not the custodian of the completed project asset, the asset is transferred to the custodian after

completion.

17 Provisions and Contingents

17.1 Provisions

Provisions are recorded in the notes to the financial statements when there is a present legal or constructive obligation to

forfeit economic benefits as a result of events in the past and it is probable that an outflow of resources embodying economic

benefits or service potential will be required to settle the obligation and a reliable estimate of the obligation can be made. The

provision is measured as the best estimate of the funds required to settle the present obligation at the reporting date.

17.2 Contingent liabilities

Contingent liabilities are recorded in the notes to the financial statements when there is a possible obligation that arises from

past events, and whose existence will be confirmed only by the occurrence or non-occurrence of one or more uncertain future

events, not within the control of the Department or when there is a present obligation that is not recognised because it is

not probable that an outflow of resources will be required to settle the obligation or the amount of the obligation cannot be

measured reliably.

17.3 Contingent assets

Contingent assets are recorded in the notes to the financial statements when a possible asset arises from past events, and

whose existence will be confirmed by the occurrence or non-occurrence of one or more uncertain future events not within the

control of the Department.

17.4 Capital commitments

Capital commitments are recorded at cost in the notes to the financial statements.

18 Unauthorised expenditure

Unauthorised expenditure is recognised in the statement of financial position until the expenditure is either:

Approved by Parliament or the Provincial Legislature with funding and the related funds are received; or

Approved by Parliament or the Provincial Legislature without funding and is written off against the appropriation in the

statement of financial performance; or

Transferred to receivables for recovery.

Unauthorised expenditure is measured as the amount of the confirmed unauthorised expenditure.

198 DEPARTMENT OF SOCIAL DEVELOPMENT ANNUAL REPORT 2021/22