Page 278 - DSD ANNUAL REPORT 2022-2

P. 278

E: FINANCIAL

INFORMA

AR

T

TION

P P AR T E: FINANCIAL INFORMA TION STATE PRESIDENT FUND

PART E: FINANCIAL INFORMATION

Notes to the Financial Statements of the State President Fund for the year ended 31 March 2022 Notes to the Financial Statements of the State President Fund for the year ended 31 March 2022

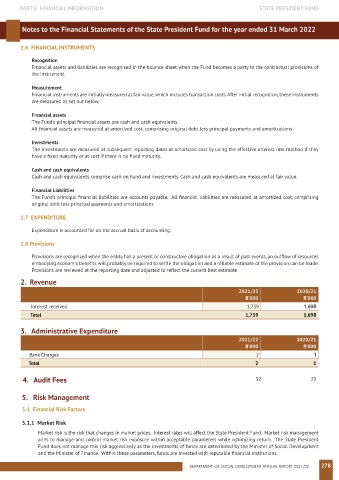

1.6 FINANCIAL INSTRUMENTS

Recognition

Financial assets and liabilities are recognised in the balance sheet when the Fund becomes a party to the contractual provisions of

the instrument.

Measurement

Financial instruments are initially measured at fair value, which includes transaction costs. After initial recognition, these instruments

are measured as set out below.

Financial assets

The Fund's principal financial assets are cash and cash equivalents.

All financial assets are measured at amortized cost, comprising original debt less principal payments and amortizations

Investments

The investments are measured at subsequent reporting dates at amortized cost by using the effective interest rate method if they

have a fixed maturity or at cost if there is no fixed maturity.

Cash and cash equivalents

Cash and cash equivalents comprise cash on hand and investments. Cash and cash equivalents are measured at fair value.

Financial Liabilities

The Fund’s principal financial liabilities are accounts payable. All financial liabilities are measured at amortized cost, comprising

original debt less principal payments and amortizations

1.7 EXPENDITURE

Expenditure is accounted for on the accrual basis of accounting.

1.8 Provisions

Provisions are recognized when the entity has a present or constructive obligation as a result of past events, an outflow of resources

embodying economic benefits will probably be required to settle the obligation and a reliable estimate of the provision can be made.

Provisions are reviewed at the reporting date and adjusted to reflect the current best estimate

2. Revenue

2021/22 2020/21

R’000 R’000

Interest received 1,739 1,698

Total 1,739 1,698

3. Administrative Expenditure

2021/22 2020/21

R’000 R’000

Bank Charges 2 1

Total 2 1

4. Audit Fees 32 29

5. Risk Management

5.1 Financial Risk Factors

5.1.1 Market Risk

Market risk is the risk that changes in market prices. Interest rates will affect the State President Fund. Market risk management

aims to manage and control market risk exposure within acceptable parameters while optimizing return. The State President

Fund does not manage this risk aggressively as the investments of funds are determined by the Minister of Social Development

and the Minister of Finance. Within these parameters, funds are invested with reputable financial institutions.

DEPARTMENT OF SOCIAL DEVELOPMENT ANNUAL REPORT 2021/22 278